Knowing the Dollar-cost averaging benefits is important. Because it helps reduce the risk of market fluctuations, build consistent investing habits, and reduce investment stress. By investing a fixed amount on a regular basis, DCA evens out asset purchases at lows and highs, giving potential long-term gains without the need to predict market movements.

The Dollar-cost Averaging Benefits You Need to Know

In the investment world, there are various strategies that can be taken to achieve long-term financial goals. One strategy that is often recommended, especially for novice investors, is Dollar-Cost Averaging (DCA).

DCA is an investment method in which a certain amount of funds investors invest regularly in a particular asset. Such as stocks or mutual funds, regardless of market price movements. While simple in concept, DCA has a number of significant benefits.

Reducing Fluctuating Market Risk

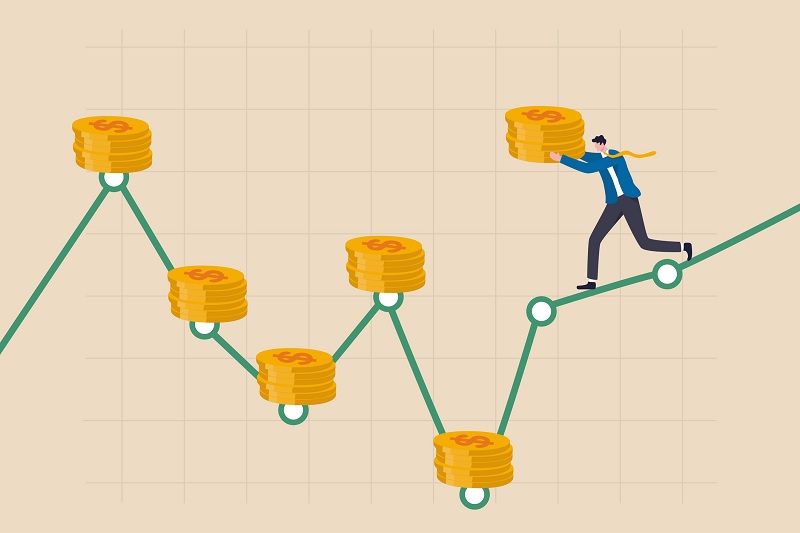

One of the main benefits of DCA is its ability to reduce the impact of market fluctuations. By investing a fixed amount at consistent time intervals, you will buy more units of an asset when prices are low and fewer when prices are high. This helps smooth out market price movements over time, reducing the risk of buying when prices are sky high and selling when prices are falling low.

Build Consistent Investment Habits

DCA encourages the formation of consistent investment habits. Because you invest a fixed amount at a set time, you automatically allocate funds for investment without having to get caught up in the emotions of the market that can influence investment decisions. This habit allows you to stay invested even in volatile market situations.

Reducing the Burden of Stress and Anxiety

The next Dollar-cost averaging benefits is minimizing the burden of stress and anxiety. Investing can often trigger stress and anxiety, especially if you focus too much on the daily fluctuations in asset prices.

By implementing DCA, you can reduce this level of stress because you don’t have to constantly monitor the market or feel pressured to make spontaneous investment decisions. This can improve your mental well-being and help you stay focused on long-term goals.

Profit Potential in the Long Term

DCA allows you to gain potential profits over the long term in a more consistent manner. While you may not always buy at the lowest price, given enough time, your average purchase is likely to be lower than if you try to ‘tinker’ the market by buying at the “right” time.

Reducing Time Pressure and Excessive Research

Investors often spend a great deal of time analyzing the market and trying to predict price movements. DCA relieves this pressure, as you only need to determine the amount you want to invest and your investment schedule. You don’t have to waste time trying to predict unpredictable market movements.

Dollar-Cost Averaging is a smart investment strategy that is easy to implement, especially for investors looking to avoid market stress and achieve long-term financial goals. Although it does not guarantee a definite return, the Dollar-cost averaging benefits is that it helps reduce the risk of volatile markets and helps you build consistent investing habits. By staying focused on long-term goals, DCA can be an effective tool in building a solid investment portfolio.